Michigan Republicans agree to income tax cut plan. Will Whitmer veto?

LANSING — Michigan House and Senate have agreed to a tax cut plan that would lower income taxes for workers, increase and expand tax relief for seniors and offer tax credits for children.

The proposal passed the House 62-42 on Tuesday and now heads to the Senate.

The agreement on Tuesday, would trim taxes by an average of $2.5 billion per year, said House Republicans spokesperson Gideon D’Assandro. The deal is a compromise between Senate and House Republicans who have offered rival proposals.

Related:

- Clerks: Michigan needs practical election reforms, not partisan posturing

- Bipartisan group seeks to revamp term limits, demand financial disclosure

- Who benefits most from tax cut plans from Whitmer, Michigan Republicans?

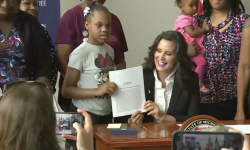

The deal could face a veto from Democratic Gov. Gretchen Whitmer, who has proposed a more modest $757 million tax cut plan to repeal the three-tiered pension tax and increase the Earned Income Tax Credit for low-income workers.

The Republican-backed plan, which preserves most of the House GOP income tax cut proposal, would:

- Lower the individual income tax rate from 4.25 percent to 3.9 percent. That means a worker making $70,000 would save $228 in state income tax payments annually.

- Allow seniors 62 years and older to deduct up to $40,000 from their income taxes annually, or $80,000 for joint filers. Currently, seniors 67 years and older can deduct up to $20,000 individually or $40,000 for joint filers per year.

- Give $500 in tax credits per child under the age of 19. A family of four with a taxable income of $42,000 a year would save $1,147 a year under the plan, with $1,000 in tax credits and $147 in income tax savings.

The agreement eliminates a Senate GOP proposal that would have slashed corporate income tax rates from 6 percent to 3.9 percent, which would have cost the state $465.5 million in fiscal year 2023.

All told, the Republican tax plan would cost $951 million in the current fiscal year, $3.1 billion in 2023 and $2.4 billion in the following year, according to the House Fiscal Agency.

The plan comes as the state budget has grown from $58 billion in 2019 to $63 billion in 2021 and $72 billion this year as federal aid poured in.

Republicans and supporters argue the plan offers all Michiganders much-needed tax relief. They have argued that Michigan’s state revenue, paired with potential budget cuts, can offset the fiscal impact in the future.

“We can afford it,” said House Oversight Committee Chair Steve Johnson, R-Wayland. “The people of Michigan are struggling right now.”

Michigan ranked 23rd among all 50 states in tax burden, a measure of the amount of tax payments as a percentage of the state’s gross domestic product, according to a study by the Tax Foundation, a Washington D.C.-based fiscal conservative think tank.

Michigan has roughly $7 billion in federal stimulus funds and another $7 billion surplus, but federal rules prohibit states from using stimulus money to fund tax cuts.

To comply with federal rules, Michigan must find $2.5 billion in new revenue or budget cuts in fiscal 2023 and $1.8 billion the following fiscal year, according to the House Fiscal Agency analysis.

Some Democrats, along with the progressive Michigan League for Public Policy, lambasted the plan Tuesday and said it puts the state at risk of losing federal money. Democrats attempted — and failed — to insert Whitmer’s proposal into the bill.

House Democratic Leader Donna Lasinski, D-Scio, called the plan “the most fiscally irresponsible action we’ve ever seen,” claiming it would blow a $6 billion hole in the budget, including $3 billion in federal funds.

“This wound to our state, our public services, our financial health will pain the people of Michigan for decades,” she said in a statement.

House Tax Policy Committee Chair Matt Hall, R-Marshall, called the claim “scare tactics” and said the state can afford the tax cut.

Late Tuesday, Whitmer spokesperson Bobby Leddy called the tax plan "unsustainable," claiming it could result in tax increases or funding cuts in coming years.

Even so, the governor still hopes for a “bipartisan deal” for a “responsible balanced budget that would put more money back in people’s pockets and make historic investments without raising taxes,” Leddy said.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!