How Michigan’s state budget process works: Important dates, taxes and hearings

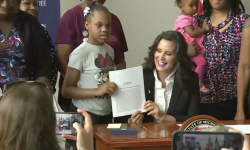

Michigan’s budget process is in full swing as Gov. Gretchen Whitmer prepares to unveil her proposed spending plan on Wednesday.

Michigan is flush with cash, including a $1.7 billion state budget, more than $5 billion in unspent federal stimulus funds and another $10 billion in federal infrastructure funds headed to the state to help fix roads, bridges, water pipes and more.

Michigan public officials and lawmakers are elected to office in part to manage the state’s money. The annual budget is a long, involved process and can take months to approve.

Related:

- Whitmer: Tap Michigan’s budget surplus to boost K-12, pre-K, mental health

- Virtual learning and the end of Michigan snow days

- Michigan’s pension tax to likely vanish, but questions on broader tax cut

Here is what you need to know about how the process works:

What is a state budget?

The state budget is the annual estimate of a state’s money and expenses. The government uses the state’s budget to fund schools, public colleges and universities, transportation, healthcare, public safety and other services.

What’s a budget cycle?

Michigan adopts a new budget every fiscal year, which runs from Oct. 1 to Sept. 30. There are five important phases in the process, known as a cycle.

State departments figure out what they need and what they are spending in August. The governor receives their budget requests in October and agencies convene budget hearings.

Following budget hearings, the state Legislature receives the governor’s proposed budget in February. The Legislature can review and adjust the budget before adopting it. Lawmakers strive to adopt the budget by July 1, but they have missed that self-imposed deadline.

By law, the governor must sign a final and balanced state budget by Oct. 1 when the new fiscal year begins. Michigan is one of 44 states in which the governor can veto specific items, line by line.

Where does the money come from?

Money in the state budget generally comes from taxes, licensing fees, returns on investments and federal grants. People who want to hunt, drive or start a business pay the state a license fee. The state collects taxes on income and sales. Sales tax is 6 percent on most items but it can vary on other items, such as marijuana, which is taxed at 10 percent.

Most of Michigan’s money comes from sales taxes, income taxes (4.35 percent) and federal funding.

What is the budget spent on?

The state spends its budget on government salaries, infrastructure, retirement, public health insurance, transportation, education and public assistance. Most of the budget is spent on education and public healthcare.

What funds are in Michigan’s budget?

Michigan has three major funds: the general fund, the School Aid Fund and the Budget Stabilization Fund, also known as the “rainy day fund.”

The general fund is Michigan’s primary operating fund and was estimated at more than $13 billion; 85 percent of the budget is spent on health and human services, public safety, education, and debt. Michigan spends the remaining 15 percent of its general fund on 13 state departments, the judiciary, the legislature and the executive office.

The School Aid Fund, estimated at $16 billion in 2021, supports K-12 schools, intermediate school districts and some postsecondary education. Michigan spends about 95 percent of its School Aid Fund on K-12 schools and 5 percent of its budget is spent on community colleges and universities.

The “rainy day fund” acts as Michigan’s savings account to help during periods of recession. It was $1.3 billion in 2021, according to the Senate Fiscal Agency.

What does it mean to balance a budget?

The governor and state Legislature are constitutionally obligated to submit and pass a balanced budget. The state balances its budget when expenses equal revenues. By law, the state cannot pass a budget that is not balanced.

A budget is not balanced when there is a surplus or deficit. A budget surplus is when the money coming exceeds spending. In turn, the state has to find a place for surplus money to go.

A budget deficit is when the state is spending more than it is earning. Generally, Michigan has a “rainy day” fund set aside for budget shortfalls.

Can Michigan balance its budget and still be in debt?

Yes.

An annual budget includes expenses that must be paid that fiscal year. State debt is generally made up of bonds that are paid over a long period of time. Michigan’s outstanding debt in 2020 was $6.2 billion.

Michigan has so far issued $1.6 billion in bonding to pay for Whitmer's $3.5 billion "Rebuilding Michigan program," which aims to rebuild or repair some of the state's most-used freeways.

How can the public get involved?

The public can participate in the state’s process budget through agency budget hearings.

Some agencies hold public forums for input on their budget request which they send to the governor. Sometimes, the governor holds town hall meetings. The legislature also takes public comments during its budget hearings in February, March and April.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!