Opinion | Michigan drivers pay small gas tax now. The free ride is over.

Everyone seems to agree that reinvestment in Michigan’s road system is necessary. But a lack of consensus persists about the magnitude of additional revenue required and how such revenue might be generated.

Two fundamental roadblocks limit policy action.

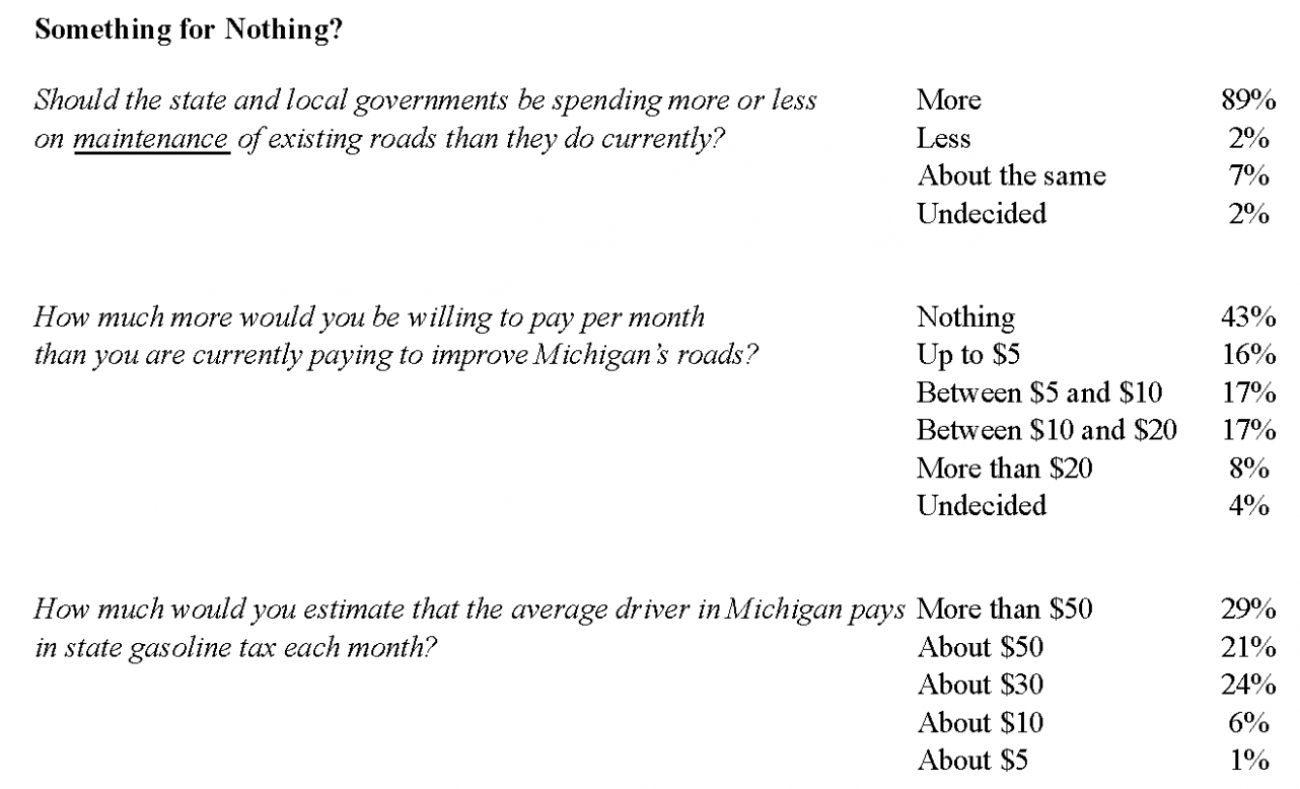

First, the desire for a “free lunch” often dominates. In a 2015 research survey, 89 percent of participants in Michigan favored more spending on road maintenance. However, when asked how much they were willing to pay, 43 percent responded “nothing” or zero for that additional road investment. Twice as many people want more road spending than are willing to pay for it.

Of course, everyone wants something for nothing, but that is seldom possible. Therefore, a first condition to solve the road-funding dilemma is convincing taxpayers that new resources must be raised.

Second, taxpayers greatly overestimate the amount they pay in fuel taxes. In the survey, half of Michigan respondents believed that the average driver in Michigan paid $50 per month or more in gas taxes. The actual amount was about $10. The major reason for this misperception is that taxpayers believed the state gas tax rate was much higher than it really was – many overestimating it by a factor of three. If taxpayers incorrectly think that they already are paying high gasoline taxes, then it is not surprising that many oppose raising additional revenue.

What to do?

Proposals to generate additional revenue for highway investment are likely to have more support and policy success if accompanied by an education effort concerning the actual amount of highway spending and magnitude of gasoline taxes. In addition, proposals for change should be translated into monthly payments for the state’s typical driver. It is self-defeating for officials to assume that taxpayers have accurate information.

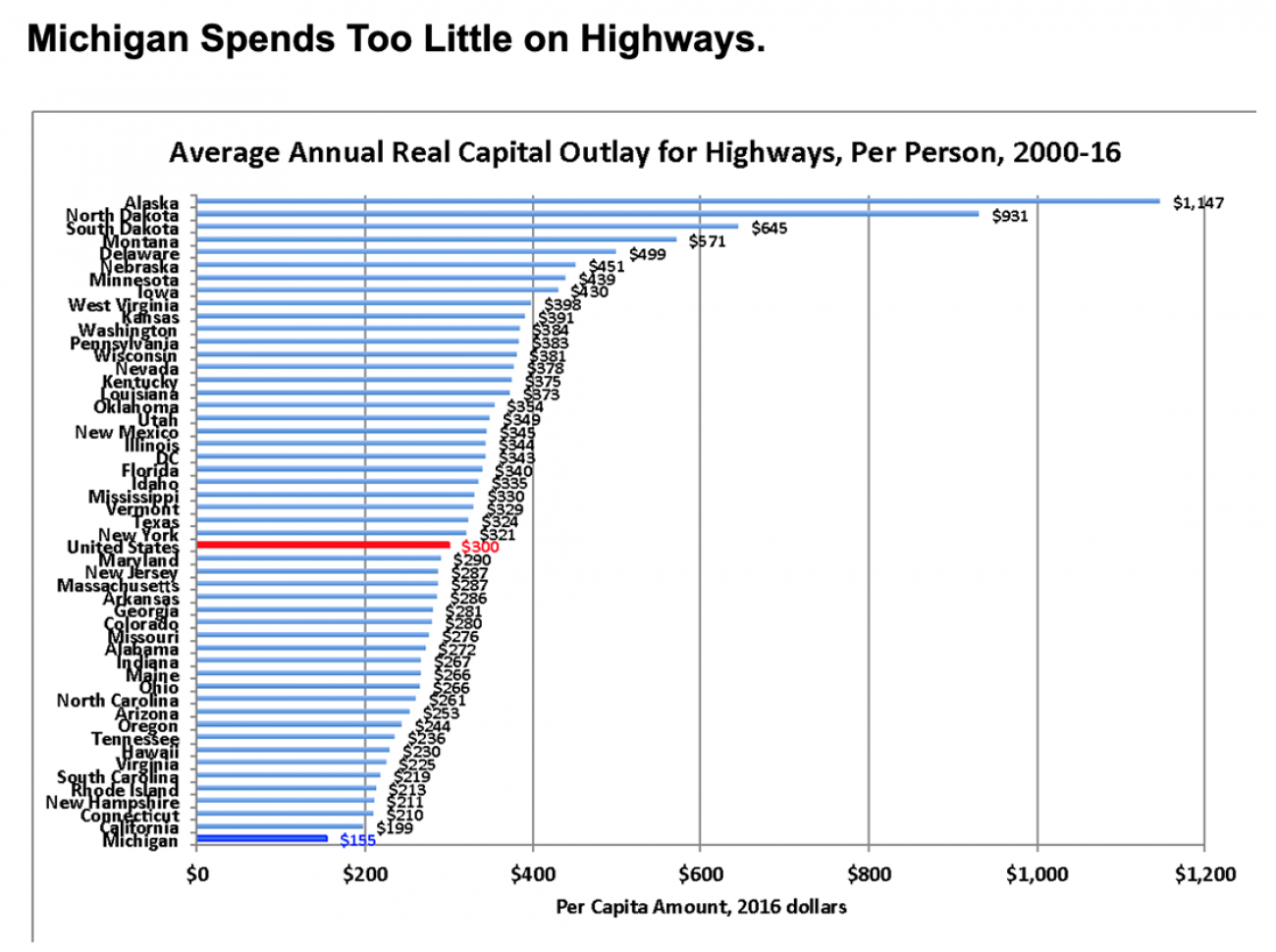

If taxpayers believe they are paying $50 per month in state gasoline tax when the actual amount is $10 or $20, it is not surprising they oppose additional revenues and investment. Rather than seeking a “free lunch,” it seems more likely that taxpayers believe incorrectly they are already paying too much for lunch. Since 2000, Michigan ranks last among the states for highway capital spending as measured by the Census Bureau. That spending includes construction, replacement and major alternations.

Michigan spent an average of $155 per person per year compared to a national average of $300. Even more telling, the average was $343 for the other Great Lakes states. To bring highway capital investment up to the national average requires at least $1.5 billion more every year going forward. It seems clear more resources are required to maintain the road structure that past taxpayers built and paid for.

At the current 26.3 cents per gallon, the typical Michigan driver pays about $12 a month in state gasoline tax. Seems clear that the “bill” for road use is quite a bit less than what many pay monthly for telephone, television, or electric service.

The calculation is straightforward. A typical driver purchases 500 to 600 gallons of gasoline yearly, so each 10 cent gas tax increase would cost a typical driver $4 to $5 per month. Similarly, a mileage fee of a half-cent per mile would cost about the same. Many taxpayers might be surprised how small these amounts are. The typical price that drivers pay for road use – or the proposed additional payment for improved roads – is equivalent to a few cups of coffee each month.

The survey results do suggest a path for policy action. More than half of Michigan citizens were willing to pay something more for road maintenance, with the median amount about $10 per month. An increase in the gasoline tax by 20 cents or a mileage fee of 1 cent per mile would cost the average driver $10 per month, and each would generate about an additional $1 billion annually for road funding. Doing both at the same time would generate about $2 billion, close to what the governor suggests is the goal.

It is time to provide clear and accurate information to taxpayers so the state can get around the roadblocks and get moving toward solving this persistent problem.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!