Job-based health coverage plummets

Linda and Ken Brauer went years without health insurance after Ken lost his job as a salesman in 2007.

Ken became eligible for Medicare in January. But Linda, a 63-year-old unemployed social worker with a master’s degree, has been unable to find work and still lacks health insurance.

“People are just so vulnerable,” said Linda Brauer, who lives with her husband in Rockford, north of Grand Rapids. “Unless this has happened to them, I don’t think they understand it.”

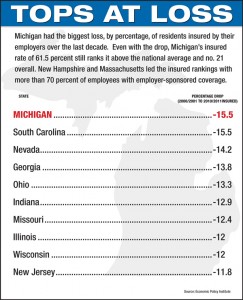

But Brauer is far from alone. Nearly 1.6 million Michigan residents lost coverage from employer-sponsored health insurance plans between 2000 and 2011 — more people than in any other state -- according to a recent study by the Economic Policy Institute in Washington, D.C.

California ranked second with 1.5 million of that state’s residents losing employer-sponsored coverage during the past decade. But California has nearly four times Michigan’s population of 9.9 million people.

In addition to the impact on workers and their families who lose employer-provided insurance, experts say the economy also suffers as poverty rises and workers pay a bigger percentage of the family budget on health insurance.

Michigan once ranked among the best states for having jobs that provided health insurance by employers. But the state has fallen far from that perch during a decade in which employers shed about 850,000 jobs and the benefits that went with them.

In 2000, 82.6 percent of Michigan adults and 75.9 percent of those under the age of 18 received coverage from employer-sponsored health insurance plans, according to the EPI study.

By 2011, those percentages had fallen to 70.1 percent and 60.1 percent, respectively.

“Michigan still has higher percentage of people covered by employer-sponsored plans than the national average,” said Elise Gould, author of the EPI study. “It’s just that Michigan started out so much better. Now it looks like a middling state.”

Nationwide, 58.5 percent of adults and 68.4 percent of children were covered by employer-sponsored health insurance in 2011.

Health costs challenge family budgets

Trying to pay for health insurance after a job loss can be a daunting task. The average premium for single coverage in an employer-sponsored plan last year was $5,615 and $15,745 for family coverage.

The cost for people purchasing their own insurance can be even higher, prompting many to go without coverage and hope they don’t become seriously ill.

“Any of us can be one tumor away from a health-care disaster,” said Jan Hudson, a senior policy analyst at the Michigan League for Public Policy.

One family’s trip from insured to struggling

Linda Brauer said she and her husband depleted their savings in paying for more than $18,000 in federal COBRA health insurance coverage for 18 months after Ken Brauer lost his job.

In order to make ends meet, the Brauers each took early Social Security retirement payments when they reached age 62, refinanced their home under a federal program that lowered their monthly payments and went on food stamps.

“It was horrifying,” Linda Brauer said. “You just don’t tell your friends and relatives. There is so much of a stigma about not pulling your own weight. You’d rather pay your fair share if you could.”

Linda Brauer has been out of the work force for decades, first as a stay-at-home mom and later as caretaker to an adult son with cancer and an ailing father, who died in 2008.

She said he has been looking for a job with health insurance benefits since then, but has had no luck.

Her husband was recently hospitalized with a heart ailment, a condition Linda Brauer said likely was aggravated because the couple couldn’t afford regular check-ups after they lost health insurance.

“It does not save money to leave people uninsured,” she said. “We should not be more concerned about putting companies at risk than the lives of our fellow citizens.”

The Great Recession strikes again

Complete coverage Complete coverageJob-based health coverage plummets Michigan’s obesity straining more than waistlines |

The huge increase in the number of Michigan residents who have lost health insurance through their employers is mainly a result of the state’s dramatic job loss, particularly in the auto industry, which has traditionally offered excellent benefits.

But there are other factors, including employers dropping coverage for workers or eliminating benefits for dependents of employees.

Still others have shifted so much of the cost of insurance to their employees that they don’t take the coverage offered, Hudson said.

“Employers can offer coverage but make it awfully difficult for their employees to afford it,” she said. “It’s an enormously complex issue.”

According to the Kaiser Family Foundation, Michigan firms are slightly more likely than those around the nation to offer health plans, though the offerings are heavily influenced by the size of the firm.

For example, while 98.3 percent of firms with at least 50 employees had health insurance, only 36.9 percent of those with fewer than 50 workers offered a plan. Overall, 52 percent of Michigan firms offered a health plan -- again a figure slightly above the national average.

Business groups say it is increasingly difficult for businesses to provide the benefit when costs continue to escalate.

“Most businesses try to offer health insurance as a way to attract and maintain good workers,” said Wendy Block, director of health policy at the Michigan Chamber of Commerce. “Employers cannot afford double-digit increases year after year.”

Businesses also are bracing for major changes under the Affordable Care Act that kick in next year.

“This year is going to be pretty much business as usual, meaning health care costs will rise three-to-four-times inflation,” said Scott Lyon, senior vice president at the Small Business Association of Michigan. “But it’s going to be a really different marketplace in 2014.”

Businesses with more than 50 workers will be required to offer health insurance coverage to workers or pay a fine.

Small businesses and individuals will be able to purchase insurance through health insurance exchanges in each state, although many details about those exchanges have yet to be finalized.

Snyder backs Medicaid expansion

Some say Michigan could boost its number of insured citizens by hundreds of thousands through a voluntary Medicaid expansion, which would be paid mostly by the federal government.

Gov. Rick Snyder has asked the Legislature to approve the expansion, a decision that was cheered by groups pushing to get more Michigan residents covered by health insurance.

Under the Affordable Care Act, the federal government would pay the cost of covering families who earn up to 133 percent of the federal poverty line until 2016 and 90 percent of the cost until 2020. Most of Michigan’s 1.2 million uninsured residents earn under 139 percent of the federal poverty line, reports the Kaiser Family Foundation.

Many Republican lawmakers are wary of expanding Medicaid, fearing that the state could eventually be tagged for much of the cost.

But a recent study by the Center for Healthcare Research & Transformation at the University of Michigan found the expansion would provide coverage to as many as 600,000 uninsured and save the state nearly $1 billion in Medicaid costs over 10 years.

Many of those would be covered work in small businesses that can’t afford to offer health insurance to their employees, experts said.

“If you’re a small business, you want employees to have health care,” said Don Hazaert, director of Michigan Consumers for Healthcare. “Why wouldn’t you want this?”

SBAM has decided to support the Medicaid expansion. Block said the state chamber is still studying the issue.

Michigan’s economy is improving, which means that more of Michigan’s 413,000 unemployed workers will find jobs and get health insurance coverage from employers, said Gould of the Economic Policy Institute.

Meanwhile, Linda Brauer is hoping she will not incur any major medical expenses until she becomes eligible for Medicare insurance coverage next year.

“I just say my prayers,” she said.

Rick Haglund has had a distinguished career covering Michigan business, economics and government at newspapers throughout the state. Most recently, at Booth Newspapers he wrote a statewide business column and was one of only three such columnists in Michigan. He also covered the auto industry and Michigan’s economy extensively.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!

CLICK TO ENLARGE

CLICK TO ENLARGE Linda and Ken Brauer have struggled to cover medical bills since the family lost its health insurance in the wake of Ken Brauer’s job loss in 2007. (Bridge photo/Lance Wynn)

Linda and Ken Brauer have struggled to cover medical bills since the family lost its health insurance in the wake of Ken Brauer’s job loss in 2007. (Bridge photo/Lance Wynn)