Whitmer seeks $5,000 tax credit for Michigan caregivers. How much will it help?

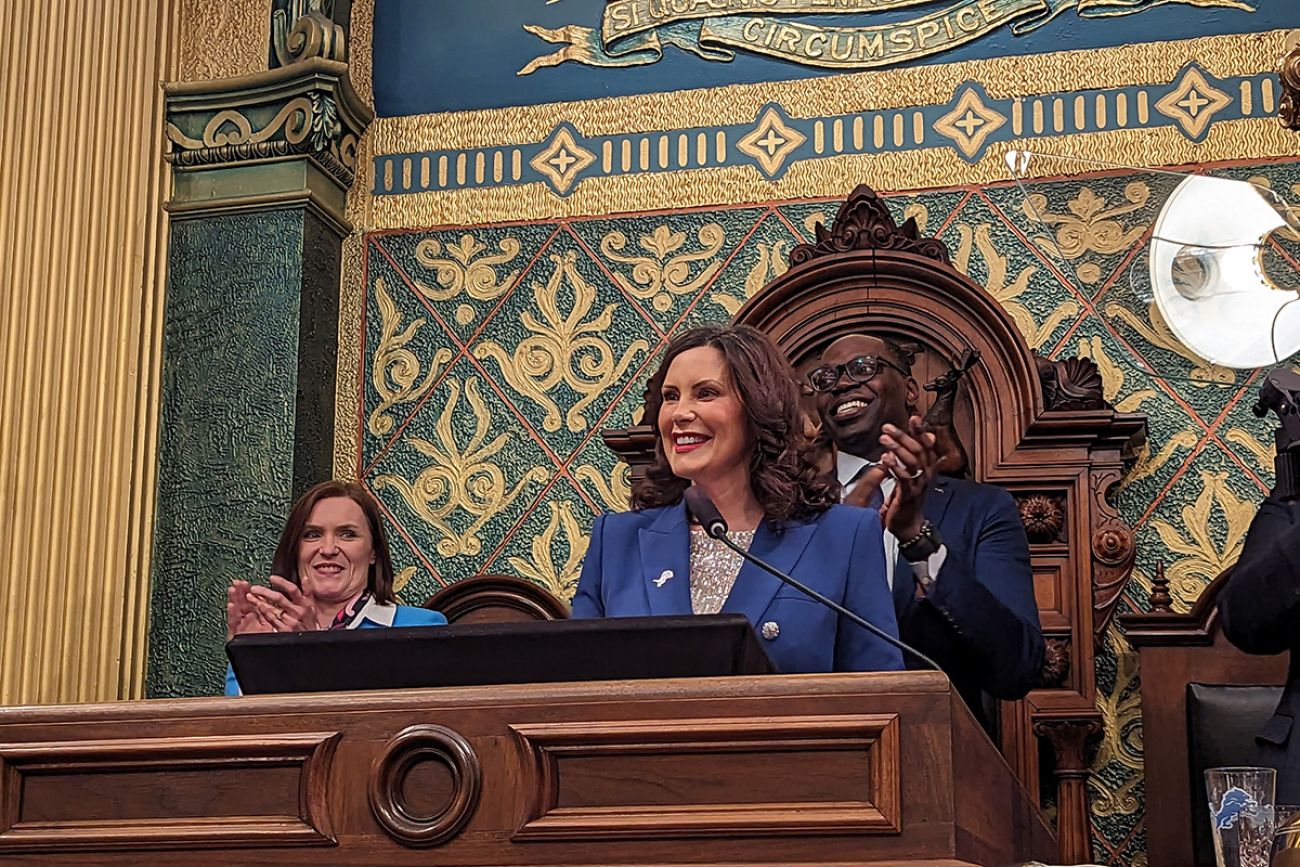

Gov. Gretchen Whitmer on Wednesday called for a new $5,000 tax credit aimed at providing financial relief for Michigan’s caregivers of aging and sick relatives.

Whitmer unveiled the plan, known as the Caring for MI Family Tax Credit, as part of her sixth State of the State address. The proposal calls for families to receive up the tax credits for caregiving expenses like transportation, counseling, nursing, and respite care, or temporary relief from caregiving responsibilities. The tax credit, Whitmer said, would reduce financial stress family caregivers face.

“We can help more seniors age in place at home in dignity, instead of a costly or long-term option. We can support parents of children with long-term care needs by saving them money. We know the burden of caregiving falls disproportionately on women and especially women of color. While the caregiving work they do is often invisible, it is invaluable,” Whitmer said.

This story was produced through the New York & Michigan Solutions Journalism Collaborative, a partnership of news organizations and community groups dedicated to rigorous and compelling reporting about successful responses to social problems. The group is supported by the Solutions Journalism Network.

The collaborative’s Health Equity Solutions Project focuses on potential solutions to challenges in health care.

Caregiving can also be costly. Across the nation, family caregivers spend an average of more than $7,000, or about a quarter of their income on caregiving tasks, according to an AARP study.

Related:

- Whitmer State of the State 2024: More money for housing, college, childcare

- Gov. Gretchen Whitmer State of the State 2024: Read the speech

- Gov. Whitmer to propose $5,000 caregiver tax credit for Michigan families

A survey from the Glengariff Group in 2022 showed that regardless of income level, more than half of all people at every income level in metro Detroit reported having out-of-pocket expenses for caregiving, including 56% of people with a household income of more than $100,000 a year and 60% of those making less than $20,000 annually.

The survey of 1,000 caregivers was sponsored by the New York & Michigan Solutions Journalism Collaborative and included 500 caregivers from Wayne, Oakland and Macomb counties in metropolitan Detroit and 500 from three counties in western New York. There are roughly 1.2 million family caregivers in Michigan.

Caregivers who responded to the survey in metro Detroit were disproportionately people of color and often poorer than their county’s median household income.

“Often caregivers are missing work, or even sometimes leave work, to provide care for their friend or family member. And so it has a large impact in terms of changes in employment, oftentimes, and that can have a financial toll,” said Amanda Leggett, professor at the Institute of Gerontology and the Department of Psychology at Wayne State University whose research focuses on caregiving for people with dementia.

“But then there are just so many expenses and costs just associated with care. So it could be everything from bringing in paid care into the home or exploring outside of the home, long-term care options.”

The COVID-19 pandemic illuminated how caregiving can exact emotional and financial distress. The pandemic served as the impetus to institute policies that alleviate the challenges caregivers endure.

Whitmer didn’t provide details of her plan Wednesday, but Leggett said a proposal represents a positive step in supporting caregivers.

“Caregiving can be very financially burdensome. And so I think any way to support caregivers financially would be a huge benefit,” she said.

A tax credit could also help employed family caregivers pay for extra support, such as respite care. If the caregiver needs to work and can’t provide care at home, having the option to send their loved one to receive some temporary care elsewhere is crucial.

“I think it frees up some financial resources to utilize in terms of care provision,” Leggett said, noting that workplace policies, such as medical leave and paid leave, are also necessary to protect working caregivers from losing their jobs.

But the proposed tax relief plan raises some key questions about the benefit’s scope.

“Is it just something that you offset your tax liability on, dollar for dollar?” asked Donald Grimes, a senior research specialist at the University of Michigan who studies labor economics.

“For most lower income households, what people have found is, you need your tax credit to be refundable, because most lower income households don’t have that large income tax liability even at the federal level. And certainly at the state level.”

To qualify for a $5,000 tax credit in Michigan, a person needs a tax liability of at least $5,000 that’s not refundable and have an income of $125,000 a year or more, Grimes said. Low-income households typically owe “next to nothing” in taxes.

“If it’s not refundable. It’s not going to be very valuable for lower income households,” he added.

Whitmer is expected to provide more details on the cost to the state and who would qualify during her Feb. 7 budget presentation to the Michigan Legislature.

Oklahoma has the most comprehensive tax credit for caregivers in the nation. Lawmakers last year passed the Caregiving for Caregivers Act, which provides $2,000 in tax relief for a family caregiver’s out-of-pocket costs annually and $3,000 for those caring for a veteran or a person with dementia. Other states offer tax credits for caregivers but the benefits are narrow. New Jersey has a “Wounded Warrior” tax credit that provides a maximum $675 credit to caregivers of veterans. South Carolina covers expenses for nursing home care.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!