Mining tax could spur more U.P. mining

State lawmakers and Gov. Rick Snyder are poised to approve a new tax structure on metallic mining operations that could spur development of new mines — like the controversial Eagle Mine near Marquette — across the western Upper Peninsula.

The state House of Representatives, on Nov. 29, approved legislation authorizing a 2.75 percent severance tax on nonferrous metallic mining operations. It would replace local property taxes and most other states taxes that metallic mines currently pay; the Senate and Gov. Rick Snyder are expected to approve the tax by the end of the year.

The full package, which includes establishing a rural development fund, covers House Bills 6007-6012.

State officials said the new tax structure on metallic mines won’t reduce overall tax revenue for schools or local units of government, or impose significantly higher taxes on mining firms.

State Rep. Matt Huuki, a Republican from Atlantic Mine who sponsored the legislation, said the new tax structure would make it financially easier for companies to open new mines in the job-starved Upper Peninsula. The reason: A severance tax delays taxes until a mining firm is producing minerals and generating revenue.

“With a very straightforward taxation system, investors will feel very secure in investing in the mineral commodities we have in the Upper Peninsula,” Huuki said.

Michigan Department of Natural Resources spokesman Ed Golder said the Snyder Administration believes the severance tax will “benefit local communities, help draw investment to Michigan and support long-term economic development in rural communities.”

Officials at London-based Rio Tinto, which owns the Eagle Mine, also support the severance tax, spokeswoman Deborah Muchmore said.

Too good a deal for miners, say bill critics

Critics, however, say the 2.75 percent tax was too low and contained several loopholes.

Previous coverageMines begin digging into U.P. free of state tax (Nov. 1, 2011) Taxation on resources varies widely among states (Nov. 2, 2011) |

“The Huuki legislation is a good concept, but we feel the proposed tax rate of 2.75 percent is much lower than it should be and gives too many exemptions for transportation and regulatory compliance costs,” said Brad Garmon, director of conservation and emerging issues for the Michigan Environmental Council.

Garmon also said the severance tax should not be rushed through a “lame duck” legislative session. Huuki, for instance, was voted out of office last month and will leave the Legislature at the end of 2012.

“We need to have more extensive public discussions about how severance tax money would be allocated,” Garmon said. “It’s too important a matter to rush through the (Legislature’s) lame duck session.”

Huuki’s legislation calls for local units of government to receive 65 percent of revenue generated by the metallic mining severance tax. The state would receive the remaining 35 percent, most of which would be used for economic development activities in rural areas.

The mining severance tax is similar to the tax that oil and gas drillers pay in Michigan. The 2.75 percent tax rate is comparable to several other states except Florida, which levies an 8 percent mining severance tax.

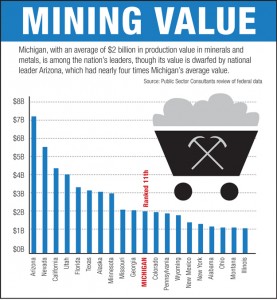

Most of Michigan’s $2 billion mining industry is currently exempt from severance taxes the state levies on other extractive industries, such as oil and natural gas producers. The lone exception is low-grade iron mines, which pay a severance tax of 1.1 percent per ton of iron extracted.

The new severance tax would apply to all metallic mines in Michigan.

A severance tax requires mining firms to pay taxes on the sale of minerals to smelting firms. Currently, mining companies in Michigan pay property taxes as soon as they acquire land, which can be years before a mine produces any metals or revenue.

Huuki’s legislation was spurred by Rio Tinto’s controversial Eagle Mine, which is expected to extract 550 million pounds of nickel, copper and other metals from state land near the headwaters of the Yellow Dog and Salmon Trout rivers. The Eagle Mine won’t produce metals or generate revenue until 2014, but the company has already paid $4 million in property taxes on the facility, Muchmore said.

Rio Tinto is one of several foreign corporations developing or studying the possibility of opening new metallic sulfide mines in the western U.P., according to state records.

Metallic sulfide mines are controversial because the rock that contains valuable nickel and other metals contains high levels of sulfides. When exposed to air and water, those sulfides create sulfuric acid, which has polluted rivers near numerous metallic sulfide mines around the world.

The Eagle Mine has divided Upper Peninsula residents, sparked legal challenges and acts of civil disobedience at the mine site. Critics contend the environmental risks associated with metallic sulfide mines outweigh economic benefits that usually last a few years.

The U.P. has a rich mining history that dates back more than a century, but most of the region’s copper and iron mines closed decades ago. The industry’s decline decimated many communities and left the region struggling to create new jobs.

Data recently compiled by the community development group Northern Initiatives found that the jobless rate in most U.P. counties is well below the state average of 9.1 percent in October. However, all 15 U.P. counties had a median household income in 2009 below the state and national averages, Northern Initiatives reported.

Huuki said improved mining technology and the region’s abundant minerals have made metallic mining the region’s best hope for new, high-paying jobs.

“Numerous companies are investing millions of dollars and researching the minerals we have in the U.P. and now we have a tax structure that makes us competitive worldwide,” Huuki said. “I think we have a great opportunity to see the U.P. recover economically.”

Jeff Alexander is owner of J. Alexander Communications LLC and the author of "Pandora's Locks: The Opening of the Great Lakes - St. Lawrence Seaway." He’s a former staff writer for the Muskegon Chronicle.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!