Land Wars: Senator targets private land conservancies

A state senator who introduced Michigan’s controversial land cap law now wants nonprofit land conservancies to pay property taxes -- unless they provide unlimited public access and allow motorized vehicles in privately owned nature preserves.

Sen. Tom Casperson, R-Escanaba, said he has drafted legislation that could ensure public access to tens of thousands of acres of private natural areas owned by groups like The Nature Conservancy.

"This will provide more recreation opportunities and ensure residents get some benefit from their communities receiving fewer tax dollars due to the tax exemption in current law," Casperson said.

Critics contend Casperson’s property tax proposal is unprecedented and would force land conservancies, which usually are nonprofit groups, into a no-win situation: Provide unrestricted access to nature preserves and allow activities that could devastate fragile ecosystems, or pay hefty property taxes to maintain control over those areas.

Previous coverageHow much of Michigan should public own? DNR's prominence, legislative bill-paying cause angst in Northern Michigan |

"This proposal really sets up a contradiction," said Brian Price, executive director of the Leelanau Conservancy. "To qualify for the property tax exemption, you have to operate natural areas and protect significant natural habitat -- this legislation would take away our ability to protect and manage those areas."

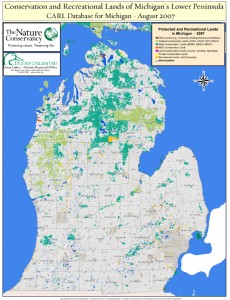

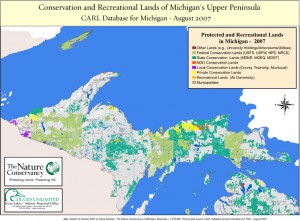

There are 30 active land conservancies in Michigan. Collectively, those conservancies own about 84,000 acres of land -- less than one-quarter of 1 percent of all the land in Michigan, according to the Heart of the Lakes Center for Land Conservation Policy in Lansing.

Private land conservancies own some of the most spectacular natural areas in Michigan, including Brockway Mountain in the Upper Peninsula and portions of the Pigeon River Country State Forest near Gaylord. Those sites are open to the public, but recreational activities are restricted.

Conservationists said land conservancies acquire land for a variety of purposes: to establish nature preserves that protect delicate and rare natural features; to provide public access to lakes, rivers and ecologically unique areas; and to ensure public access to snowmobile trails and other recreational resources.

Officials at several land conservancies said they allow unlimited public access at most of their sites, but prohibit motorized vehicles and restrict other activities in natural areas to protect fragile resources like sand dunes, wetlands, trout streams and endangered plants.

"Our properties are open to the public, but not to motor vehicles because we are offering the chance to experience a quiet natural area," said Tom Bailey, executive director of the Little Traverse Conservancy.

"It would certainly change the experience on hiking trails if you have motorized vehicles running around," Bailey said. "It would be noisy, you wouldn’t see as much wildlife and you would have erosion damage in areas."

Glen Chown of the Grand Traverse Regional Land Conservancy says he is not aware of any state that currently levies property taxes on nonprofit land conservancies that limit public access or use of privately owned nature preserves.

The Michigan Constitution and the state’s General Property Tax Act afford property tax exemptions to conservation groups, religious organizations, schools and certain other nonprofits.

Casperson’s draft legislation apparently wouldn’t conflict with the state Constitution. Instead, it would add amend the Property Tax Act.

The legislation, a copy of which was obtained by Bridge, is Casperson’s latest controversial initiative involving environmental policy.

The Legislature and Gov. Rick Snyder recently passed a law that limits the Michigan Department of Natural Resources’ ownership of state land to 4.626 million acres, until the agency develops a land acquisition strategy. Casperson authored that bill, which also requires the DNR to receive legislative approval before buying any more land north of Clare.

The vast majority of land held by conservancies in Michigan is found north of Clare, as well.

Casperson said the land cap was needed to limit public land ownership in Northern Michigan and rein in an agency that continues to buy land despite lacking sufficient funds to properly maintain the land it already owns.

Rich Bowman, director of government relations for The Nature Conservancy’s Michigan chapter, said he believes Casperson’s property tax proposal is a response to changing land ownership in the Upper Peninsula.

Large tracts of U.P. forestland owned by paper mills, which often allowed unrestricted access and activities, have been sold recently to real estate investment trusts that want their property certified as environmentally sustainable, commercial forests. Achieving that type of certification often requires limiting public access and banning motorized vehicles, Bowman said.

Bowman said Casperson’s proposal would make it more difficult for land conservancies to acquire and protect land with valuable natural features.

"I don’t think Sen. Casperson has any malicious intent, I’m just not sure he understands the ramifications of his proposal," Bowman said.

Bailey said Casperson’s tax plan unfairly singles out land conservancies -- it wouldn’t apply to church groups or other civic organizations that own nature preserves. He also challenged Casperson’s claim that tax-exempt nature preserves are a financial drain on local units of government.

"Realtors tell us time and time again that there is an enhancement to neighboring land values when a natural area is preserved," Bailey said. "We need areas where motorized vehicles are allowed, and we have a lot of them, but we also need quiet natural areas and those are getting harder and harder to find."

Jeff Alexander is owner of J. Alexander Communications LLC and the author of "Pandora's Locks: The Opening of the Great Lakes - St. Lawrence Seaway." He’s a former staff writer for the Muskegon Chronicle.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!