Critics fear Michigan is promising the moon to land cloud data storage firms

LANSING – Michigan’s next big battle over tax incentives focuses on server farms, as state officials try to lure massive cloud storage data centers that Facebook and Google are opening in other states.

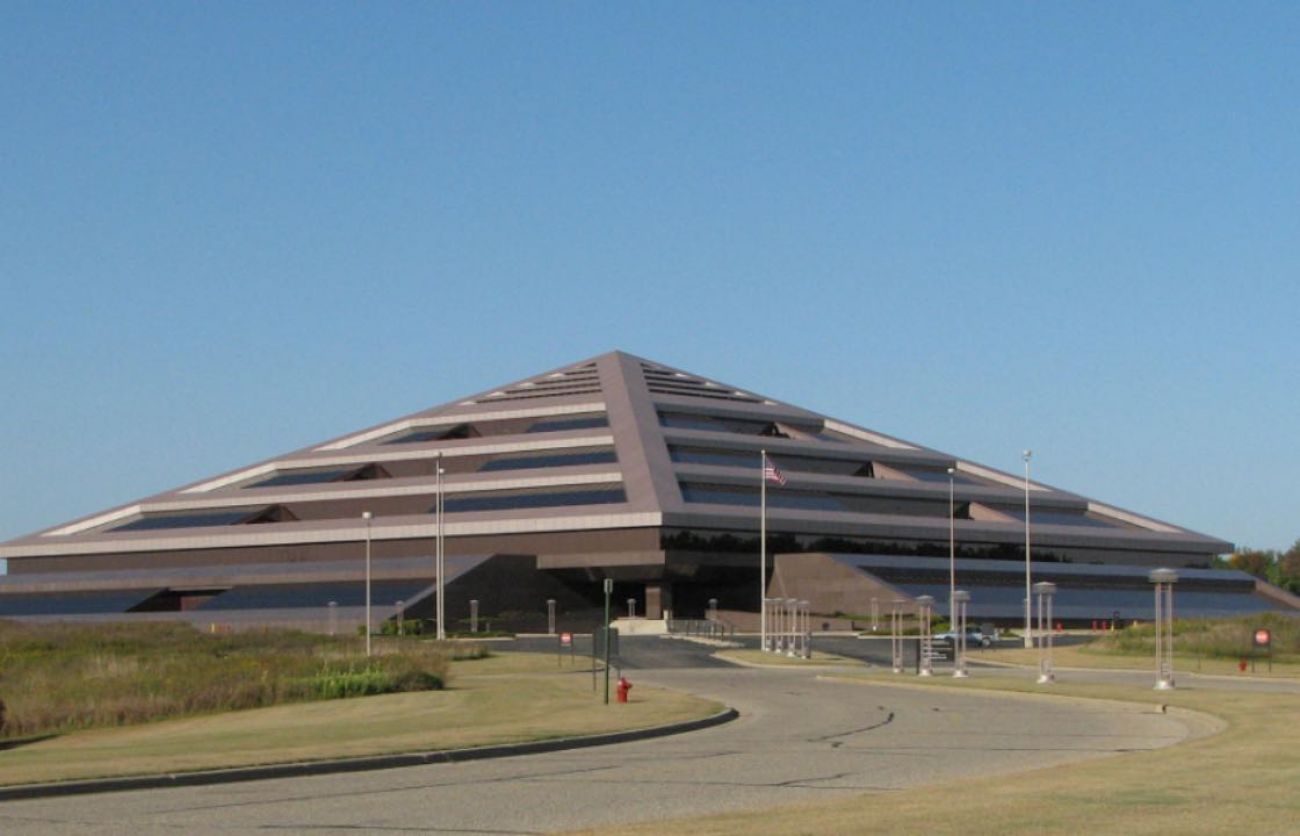

Four years after using a tax break to lure a Switch data center to a pyramid-shaped building in west Michigan, lawmakers are considering bipartisan legislation that would create a similar sales and use tax exemption for large “enterprise data centers” utilized by online companies – and potentially by automakers to store autonomous vehicle data.

“It’s about attracting big game to Michigan,” said Steve DelBianco, president of Net Choice, a big tech lobbying firm for companies like Facebook, Google and Twitter.

"These data centers will either be here, or they won't be here," he recently told Michigan lawmakers on the House Commerce and Tourism Committee, suggesting the decision by tech firms "hinges" on the kind of sales tax exemption that at least 25 other states have already adopted.

The proposal faces pushback from critics who argue it would siphon future tax revenue from a state struggling to fund public schools and fix roads.

“Each state is giving out money, money, money to whichever corporation wants to come, and it’s a race to the bottom,” state Rep. Yousef Rahbi, D-Ann Arbor, told Bridge Magazine. “We're participating in it, and it disgusts me.”

To qualify for the proposed tax break, an enterprise data center would need to make a capital investment of at least $250 million in a Michigan facility and employ at least 30 full-time employees at 120 percent of the average wage in the county they locate.

Over the past five years, no major enterprise data center has located in a state that imposes its full sales tax on server equipment, DelBianco said.

He pointed to a $750 million Facebook data center in New Albany, Ohio, where the company is building a third server farm after first choosing the site in 2017. Since 2016, Google has spent $10.5 billion to construct six data centers in Iowa, North Carolina, Oklahoma, Georgia, Oregon and South Carolina, he said.

"Those data centers generate new income and business taxes," DelBianco said. "They generate sales tax on all their equipment that isn't exempt. It's not just the servers that go into these centers."

The proposal is causing heartburn for public school groups, whose opposition swayed some Democratic lawmakers and prompted Commerce Committee Chairman Steve Marino, R-Harrison Township, to delay a panel vote he had planned for Thursday.

School advocates worry because roughly 73 percent of all state sales tax revenue is earmarked for the School Aid Fund that supports K-12 districts across the state. Firms would be exempt from that tax when purchasing computer servers for their data centers.

Rep. Rebekah Warren, an Ann Arbor Democrat who opposed the Switch tax break in 2015 but is co-sponsoring the new package, is preparing a unique “hold harmless” amendment she said will “guarantee” schools do not lose money.

Under pending language reviewed by Bridge, the state Treasury would be required to backfill the School Aid Fund with an amount “equal to all revenue lost” as a result of the tax exemption.

“For us, there is no lost revenue,” Warren said, arguing the tax break would lure companies who otherwise would never choose Michigan. “There’s only potential revenue to be gained by putting up a welcome mat to these industries.”

But hold harmless promises have not been honored in the past and assume “that costs don’t elevate” for schools, said Peter Spadafore of the Michigan Association of Superintendents and Administrators.

Public school advocates point out new data center developments could increase costs for local districts if an influx of employees enroll their children. They note employers are also often seeking quality educational opportunities to attract talented workers.

“You can’t expect better results and an educated workforce if you continually cut revenue to state resources like education,” Spadafore said.

And if the state does backfill the School Aid Fund to prevent losses there, that would mean less money for the general fund, the state’s main pot of discretionary revenue, said Tim Greimel, a former state lawmakers who now lobbies for the AFSCME Council 25 union group.

"Let's not pretend the general fund is just free money or doesn't matter," Greimel said, noting the fund is used to pay for mental health care, road repairs and revenue sharing for local government services. "Those are items I think the residents of the state care deeply about."

While states have rushed to offer tax breaks to growing tech firms, data center incentives have been "heavily criticized" by researchers, said Nathan Jensen, a University of Texas-Austin professor and co-author of "Incentives to Pander."

He compared data center incentives to "ineffective, high cost" subsidies for the film industry and sports stadiums.

"Data centers are particularly bad projects at generating jobs," Jensen told Bridge Magazine, noting server farms generally require a small number of employees. "But then there's also associated costs like water and power. The only benefit of a data center is tax revenue, and then you're giving away this revenue."

That's a far cry from the rosy picture painted by Barbara Comstock, a former congresswoman and state lawmaker from Virginia who helped pass a data center tax break law there after her state lost out on an Apple server farm in 2011.

Less than a decade later, Loudoun County, Virginia has become the data center capital of the world, said Comstock, who is now an adviser for the NetChoice lobbying group. Property taxes, income taxes and other revenues related to the centers have been a "cash cow" for her region, she told legislators.

The Apple data center that Virginia lost out on in 2011 ended up going to North Carolina, where state and local governments offered the firm a combined $321 million in incentives to create 50 direct jobs.

The North Carolina package amounted to $6.4 million per job, the most expensive subsidy of its kind, according to Good Jobs First, a left-leaning policy research group based in Washington, D.C. that has called data incentives "money lost to the cloud."

Nothing in the Michigan legislation would prevent a data center from seeking other local and state tax breaks or incentives. And that's what Switch, the Nevada-based firm that legislators changed Michigan law for in 2015, did at the time. It reached a separate "renaissance zone" agreement with the state and local government.

Switch, which has 62-full time employees in Michigan, is now asking lawmakers to change state law again to ensure it is not subject to a local school millage or a property tax to repay school bonds.

That was the company's expectation when it opened its data center in suburban Grand Rapids, according to Switch lobbyist Natalie Stewart.

"Revenue that might be achieved through these assessments should never have been figured into any equation as it was never supposed to be assessed or collected," she told lawmakers in committee.

That was the “intent,” Stewart said. But that's not what the renaissance zone agreement the company signed in 2016 actually said, and after granting an exemption for nearly three years, Gaines Township recently sent Switch and its clients a tax bill.

Legislation approved in September by the full Senate and narrowly advanced Thursday by the House Commerce Committee, could save Switch at least $373,000 a year in local taxes, according to the non-partisan Senate Fiscal Agency.

The savings could top $20 million a year if Switch follows through on plans to invest $5 billion in the pyramid complex in Gaines Township. That’s money that could have otherwise ended up with local schools.

The original Switch legislation included "hold harmless" language education officials say was never honored. But a new and tentative agreement reached between Switch, Caledonia and the Kent Intermediate School District would guarantee replacement dollars for the School Aid Fund.

The deal, outlined before the House panel approved the new tax break in a 6-4 vote, would also require a 10 percent real property tax increase for the company while it is in a renaissance zone, providing "guaranteed growth" in local revenue, said Chris Glass of the West Michigan Talent Triangle.

The 2015 law included a sales and use tax exemption for all “co-location” data centers that provide storage to multiple companies, entities or individuals at a single facility.

The Michigan Data Center Alliance, a group of firms that operate 38 other data centers in the state, has spoken out against the new Switch bill, arguing the change would favor a “single company with political clout and well-connected lobbyists.

“The Switch special tax carve-out clearly harms local schools, local governments and local communities, leaving taxpayers on the hook for hundreds of thousands, if not millions, of dollars,” Carrie Wheeler, the alliance’s executive chair, said in a statement.

Supporters say the "enterprise" data center tax break bill is unrelated to Switch because it would only apply to server farms operated by a single company to house their own data.

But it would also extend the sales and use tax exemption for Switch and other co-location data centers by 20 years, from 2035 to 2055. That’s a provision that could be changed to more narrowly focus on enterprise data centers, Rep. Bronna Kahle, R-Adrian, said in committee testimony.

"It's important that we make sure our business, our communities, our families don't miss out here in Michigan," she said, noting neighbors like Ohio and Indiana are among at least 25 states that have already adopted tax breaks for enterprise data centers.

Michigan's cold winters would actually be an asset, Kahle argued, noting data centers create a large amount of heat but must remain cool to function properly.

"These bills will put an open for business sign for large online companies interested in opening data centers in our state," Kahle said.

Warren opposed the Switch tax break in 2015, arguing the firm should not qualify for the same type of sales tax exemption as food and prescription drugs.

"One of these things is not like the others," she said at the time, channeling Sesame Street. "One of these things just doesn't belong."

But Warren is now backing the same kind of sales tax exemption for enterprise data centers, calling it a "tool" that will encourage new investments that could help one of the state's most important industries.

"Every single autonomous vehicle... will use 4 terabytes of data every day," she said in committee. "That data has to live somewhere. Let's throw out the welcome mat. Let's encourage other companies that are doing research and development here to house their data here."

To qualify for the tax break, an enterprise data center would have to pay employees at least 120 percent of the average wage in the county where the facility is located.

That provision is "unlikely to have a significant economic impact" because tech positions already pay more more than the average job, according to an analysis by the nonpartisan House Fiscal Agency.

The average wage in Oakland County was $63,000 last year, the highest in the state, but computer systems analysts earned an average of $83,900.

“While some specific employees might benefit from this provision, it would not be expected to have wide-ranging effects,” the agency said.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!