Advocates urge Michigan lawmakers to make caregiver tax credit a reality

With the state’s fiscal budget deadline less than two months away, caregiver advocates have been ramping up pressure on Michigan legislators to add a tax credit aimed at assisting family caregivers squeezed by expensive, out-of-pocket costs.

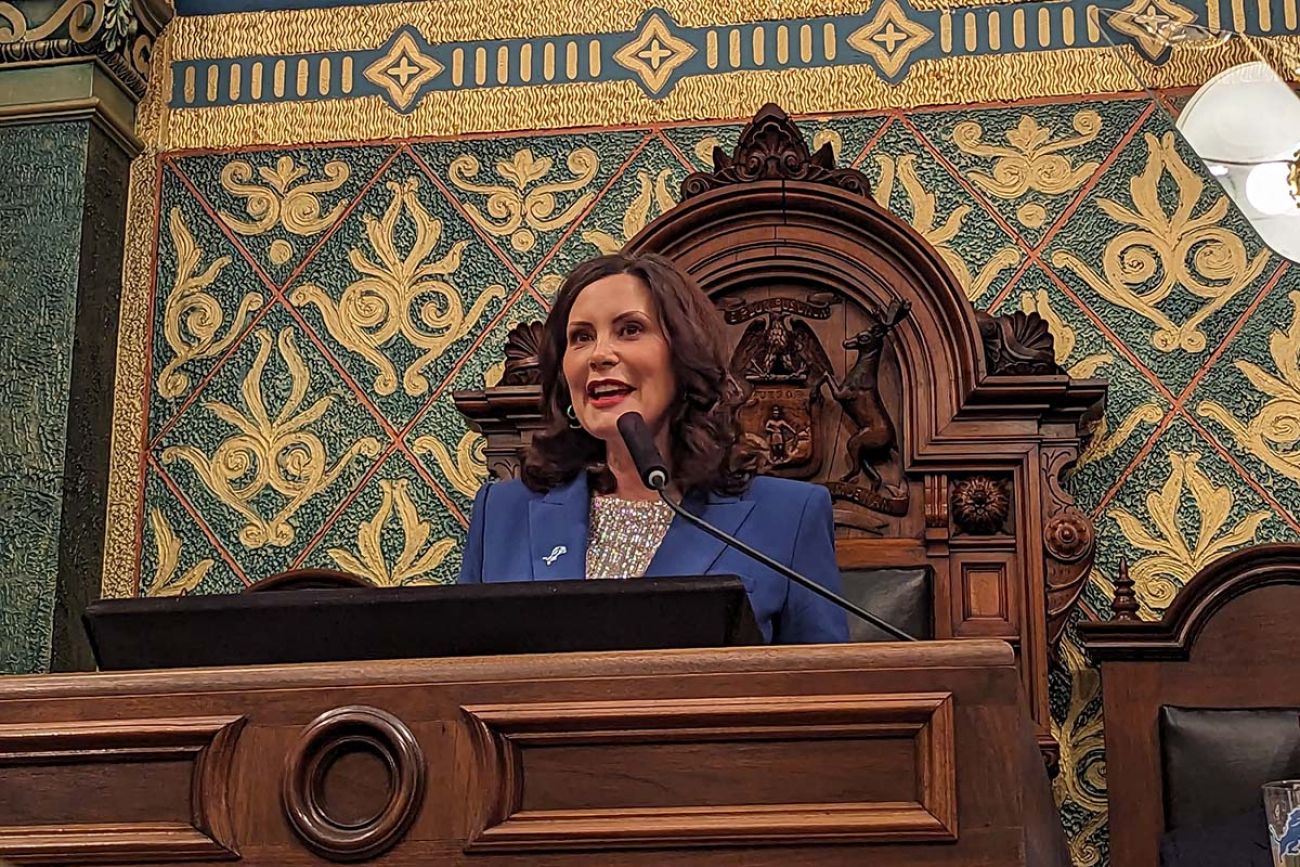

Gov. Gretchen Whitmer introduced the Caring for MI Family Tax Credit during her sixth State of the State speech in January, signaling the cost of caregiving is a major priority. Under her plan, eligible caregivers, including those who care for aging and sick relatives, could receive a tax credit up to $5,000 to write off expenditures from counseling, transportation and respite care, or temporary relief from caregiving, and other related expenses. Whitmer said the tax credit would reduce financial stress family caregivers face.

This story was produced through the New York & Michigan Solutions Journalism Collaborative, a partnership of news organizations and community groups dedicated to rigorous and compelling reporting about successful responses to social problems. The group is supported by the Solutions Journalism Network.

The collaborative’s Health Equity Solutions Project focuses on potential solutions to challenges in health care.

The credit could cost the state up to $37.5 million in the upcoming fiscal year, as outlined in an executive budget proposal. It’s unclear how many caregivers could benefit from the credit if signed into law.

Related:

- As Alzheimer’s grows, cities work to earn ‘dementia-friendly’ status

- Medical debts crush 14M Americans; Michigan programs aim to ease the burden

- Program offers familiar setting for elderly, respite for caregivers in Michigan

Months have passed without action from a Legislature controlled by Democrats, and the agenda item was missing from the latest slate of budget bills passed by the House and Senate chambers. The Legislature’s self-imposed deadline to pass a budget before summer recess is July 1 although there is no penalty if it is missed.

“It’s disappointing to see,” said Melissa Seifert, associate state director of government affairs for AARP Michigan.

“We are doing all we can to elevate this issue and make sure that our caregivers’ voices are heard. This is a really essential part of caregiving to get some type of reimbursement back.”

Leaders from the aging nonprofit and Lt. Governor Garlin Gilchrist organized a news conference in Lansing last week to galvanize support for the inclusion of the tax credit in the budget for the fiscal year that begins Oct. 1.

Michigan is home to roughly 1.7 million unpaid family caregivers, according to AARP. From cooking meals, giving baths to delivering medications, caregivers are lifelines to loved ones who can no longer manage their personal health alone.

“We constantly hear from our members that over 90 % want to age in their home,” Seifert said. “They don’t want to have to go to some institution or some retirement community.”

State Rep. Sarah Lightner (R-Springport), the minority vice chair of the House appropriations committee, didn’t respond to requests for comment.

Family caregivers of older adults in Michigan accumulate 1.1 billion hours annually of voluntary care, which translates to a worth of $19.6 billion each year. That labor can spur anxiety, stress, illness and economic hardship. On average, caregivers personally spend more than $7,000 annually on out-of-pocket expenses, an AARP study found. For Black caregivers, those costs represent on average 34% of their income. The figure is higher for Latino caregivers, whose out-of-pocket expenses constitute 47% of their income.

We constantly hear from our members that over 90 % want to age in their home. They don’t want to have to go to some institution or some retirement community. - Melissa Seifert, AARP Michigan

Both the federal and state governments are working to solve the nation’s senior care crisis. In April, Nebraska passed a tax credit of up to $3,000, similar to Oklahoma’s, which goes into effect at the beginning of next year. A few other states have limited benefits. New Jersey has a “Wounded Warrior” tax credit of $675 for caregivers of veterans. South Carolina covers expenses for nursing home care. In January, a bipartisan group of U.S. senators and members of the U.S. House of Representatives reintroduced a nonrefundable tax credit of up to $5,000 for eligible family caregivers.

The majority of caregivers are women. Black and brown female caregivers often face higher burdens of caregiving and higher rates of health disparities. Some also juggle caregiving duties and low-wage jobs with little to no benefits.

The potential passage of the tax credit is a crucial move to supporting caregivers, said Danielle Atkinson, national executive director and founder of Mothering Justice, a Detroit-based grassroots policy organization that advocates for mothers of color nationwide.

“It’s really important that our budget and our elected officials acknowledge the importance of caregivers and the importance of caregiving to not only our economy, but our communities. I want this to go through,” she said.

“I’m hopeful that the Care Caucus can do some work around this, make sure that it’s in the budget.”

But Atkinson stressed a tax credit is not the full solution.

“This is not a silver bullet by any means. And even if it’s fully implemented, we want to make sure that it would be fully refundable,” she said, adding the state should also adopt a family medical leave policy.

“The most vulnerable caregivers are low income. And so we’ve got to consider what their tax burden is, and whether or not this would even be helpful for them.”

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!