Tax shift adds to fiscal woes at city hall

After years of political wrangling over the issue, business advocates hail the phase-out of Michigan's tax on industrial machinery and business equipment as a welcome tonic for job growth.

Public officials in places like River Rouge and Warren are not so sanguine.

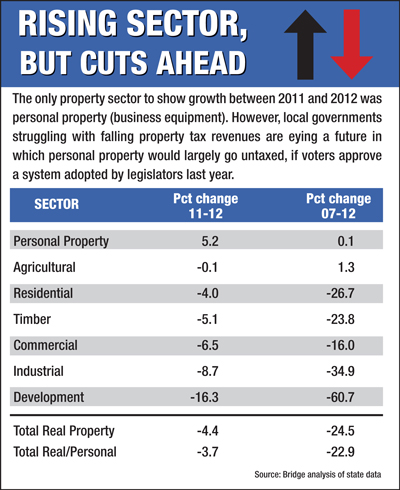

BILLIONS MORE LOST, BUT PROPERTY VALUE DROP SLOWING

“This is not going to bring in any more business,” said Warren Mayor James Fouts, referring to changes to Michigan’s personal property tax.

To the contrary, Fouts asserts, the measure will cost his community $3 million a year in lost revenue. He believes the measure will prove especially painful in heavily industrialized cities in Southeast Michigan that are particularly dependent on personal property tax revenue.

Personal property tax in Michigan is paid by businesses on property not affixed to land, such as furniture, equipment and machinery. The tax is based on voter-approved millage rates.

He has little faith that a 2014 statewide referendum to replace most of the lost revenue will do the job.

Voters must weigh in on tax shift

Under legislation passed late in 2012, the phase-out of personal property tax will not be implemented unless voters approve a measure to replace most of the revenues that would be lost to cities. The referendum would authorize approval of a compensatory fund drawn from revenues generated by the state use tax, a business tax paid on out-of-state purchases.

It would reimburse local units of government 100 percent of essential services such as police and fire protection and 80 percent for the remainder.

“Do I not consider garbage removal or road maintenance and snow removal essential? What do I do with my garbage, dump it on (Interstate) 696?” Fouts asked.

The phase-out would begin in 2014, beginning with commercial and industrial property valued at less than $40,000 per taxing jurisdiction. The repeal would extend to larger businesses in 2016 and is to be fully implemented by 2022.

Analysis of 2010 data by the Michigan Municipal League found that personal property tax is a critical source of revenue for cities with a sizable industrial base. In River Rouge, personal property comprised 57 percent of the city's taxable value, 46 percent in Ecorse, 37 percent in Romeo, 22 percent in Auburn Hills and 17 percent in Detroit. It was 15 percent in Warren and 15 percent in Saginaw.

WHAT’S PROPERTY WORTH IN YOUR HOMETOWN?

Even with replacement revenue posed by the 2014 referendum, Samantha Harkins of the Municipal League said cities across the state will continue to suffer. In addition to potential revenue losses for non-essential services, she noted that cities already lost billions of dollars in state revenue sharing in the past decade.

That's on top of an estimated $1.2 billion decline in state and local government revenue from 2007 to 2011 because of dropping property values and exemptions to the tax.

“You know that old saying, 'death by a thousand cuts,' that is literally what we are doing to our communities,” Harkins said.

WHO’S NO. 1? COUNTY-BY-COUNTY RANKINGS ON PROPERTY VALUES

“People still expect their trash to be picked up. They expect their streets to be plowed. They expect when their water comes out, it will be clean. I think that (proposed revenue replacement) fails to take into account there are other services communities are expected to provide.”

Ranks at city halls are shrinking

According to the federal Bureau of Labor Statistics, local government employment in Michigan in 2011 was down by 53,600 jobs since its November 2006 peak of 438,500. That includes employees in everything from public works to engineering to parks and recreation.

But municipalities across the state have been forced to cut even “essential” police and fire services as well. In East Lansing, the city has lost 100 employees, a fourth of all positions, since 2001. Its police force has been cut by 15 percent, to 56 officers.

Facing a $3.2 million deficit, officials in Saginaw are trying to negotiate a deal to have the Saginaw County Sheriff's Department patrol the city. If not, 10 police officers and 15 firefighters are to be laid off, leaving the city with 55 police officers and 35 firefighters.

According to the Michigan Municipal League, Michigan had lost 2,315 police officers as of 2010 since 2001. The Michigan Professional Fire Fighters Union said that 1,800 union firefighter positions have been eliminated since 2001.

According to the Michigan Municipal League, Michigan had lost 2,315 police officers as of 2010 since 2001. The Michigan Professional Fire Fighters Union said that 1,800 union firefighter positions have been eliminated since 2001.

Harkins noted that cities face the added, ongoing burden of employee pension benefits.

“Retirement costs are putting a significant strain on municipal budgets,” Harkins said.

Backers of the repeal of personal property tax say it will benefit the vast majority of Michigan communities in the long run.

Mike Johnston, vice president of government affairs for the Michigan Manufacturers Association, believes its repeal combined with a 2011 cut in business taxes will stimulate business and jobs growth. He asserts that, in turn, will generate more revenue for government.

“I think it is the most significant tax change that Michigan has made in several decades. It will make Michigan dramatically more competitive than we have ever been before.

“What we are doing with the personal property tax is eliminating a barrier to investment in Michigan. We are going to stop the outflow of jobs from Michigan.”

He pointed to a study by Lansing-based Anderson Economic Group that repeal of the personal property tax combined with the business tax cut would create between 20,000 and 45,000 new jobs.

“The communities that are complaining about this are very much in the minority,” he said.

Ted Roelofs worked for the Grand Rapids Press for 30 years, where he covered everything from politics to social services to military affairs. He has earned numerous awards, including for work in Albania during the 1999 Kosovo refugee crisis.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!