State government gives more tax breaks than it collects for schools and general government

11 things every Michigan taxpayer should know

Comparatively, Michigan's tax burden is low - and getting lower.

Look around: YOUR taxes could be much higher.

Michigan gives more tax breaks than it collects for schools/gov't.

The definition of "Anti-tax conservative" has changed

Why might taxes seem high to YOU?

The motivation for a state income tax cut.

What might YOU get out of an income tax cut?

Snyder is a Republican. Why his experts want to spend more.

Can we cut taxes and spend more on education/infrastructure?

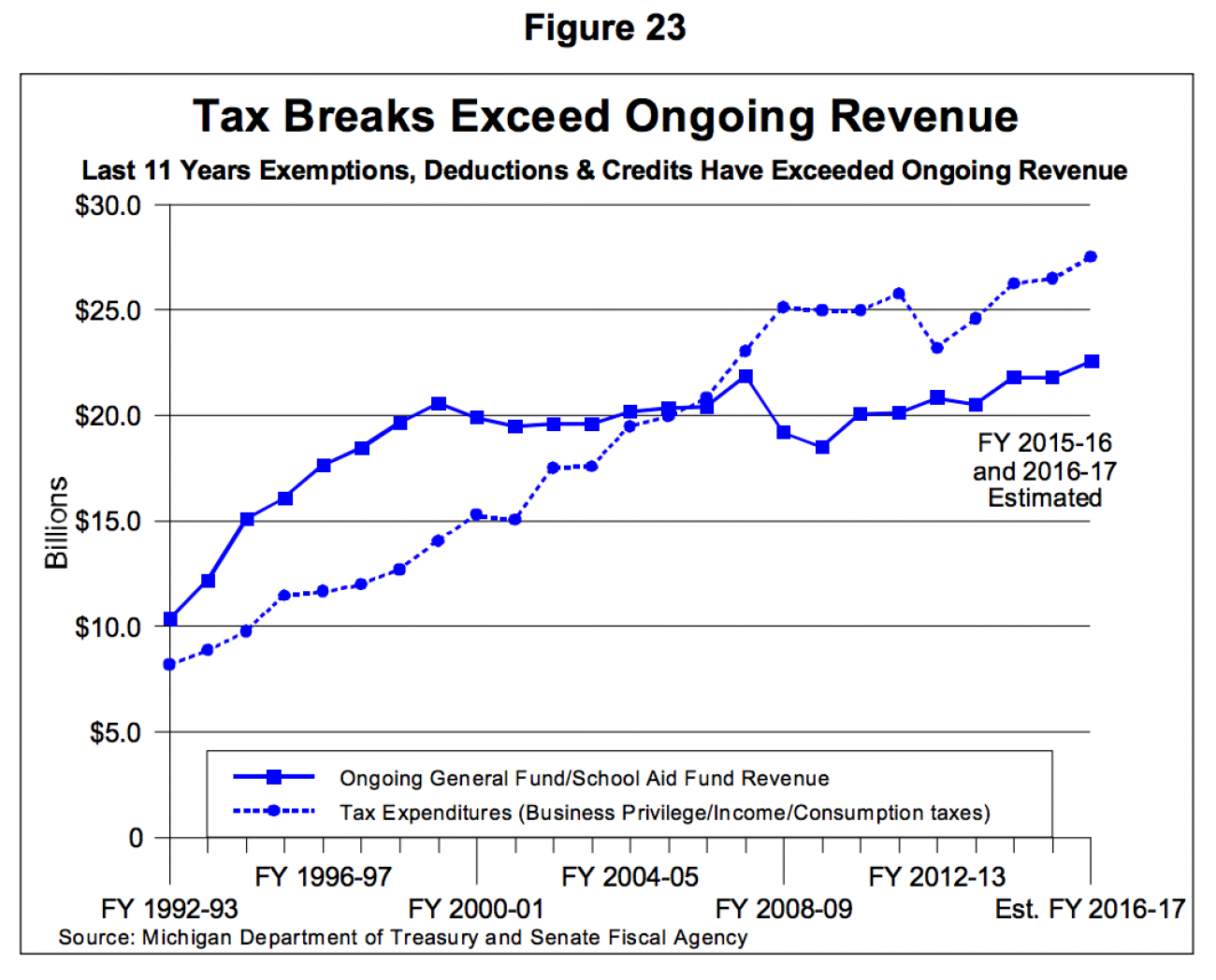

Who doesn’t love a tax break? In Michigan, there are tax breaks galore – $27.5 billion of them this year. Business tax breaks. Homestead tax breaks. Sales tax exemptions on items like food, prescription drugs and many services (from your accountant to your hairdresser).

Called “tax expenditures” in government parlance, these tax breaks are $7 billion more this year than they were in 2000 (after adjusting for inflation). That’s a 36-percent increase in state-mandated annual tax breaks since the beginning of the century.

Michigan gives more in tax breaks every year than it collects in tax revenue to pay for most government operations (the general fund) and schools (the school aid fund).

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!