Mines begin digging into U.P. free of key state tax

In September, after years of heated debate and legal battles, Kennecott Eagle Minerals began blasting into the ground at its controversial nickel mine near Marquette.

The company, a subsidiary of London-based mining giant Rio Tinto, believes the Eagle mine will yield 300 million pounds of nickel and 250 million pounds of copper. Kennecott is one of several foreign firms pursuing what are believed to be large deposits of nickel, gold and other valuable metals found in bedrock underlying the western Upper Peninsula.

Those deposits could be worth billions of dollars, but the companies that extract them from the ground won’t pay a penny in severance taxes. By comparison, if Michigan treated the Kennecott mine the way Florida would, the state's take could reach an additional $400 million.

But right now, Michigan’s mining industry is exempt from severance taxes the state levies on other extractive industries, such as oil and natural gas producers. The lone exception is low-grade iron mines, which pay a severance tax of 1.1 percent per ton of iron extracted, according to a Public Sector Consultants study* commissioned by the Center for Michigan. (Editor's note: CFM engaged PSC to produce a report benchmarking Michigan's extraction taxes with those of other states. PSC was not asked to endorse a particular policy or policy change.)

That soon may change.

State lawmakers are considering introducing legislation that would impose a severance tax on Kennecott’s Eagle mine and other metallic sulfide mines that open in the U.P., according to Dan Wyant, director of the Michigan Department of Environmental Quality.

“The severance tax would compensate for the loss of state resources,” Wyant said. “It would be a new source of revenue -- the question is how significant a source.”

Anne Woiwode, director of the Sierra Club’s Michigan chapter, praised the idea.

“My personal view is that a severance tax on any non-renewable resource makes sense,” Woiwode said. “In other states, it has been a big help in supporting state and local services demanded by these industries, as well as addressing community and resource impacts after the extraction is done.”

Charlotte Loonsfoot, a member of the Baraga-based Keweenaw Bay Indian Community that opposed the Eagle mine, said Kennecott should pay a “hefty” severance tax to compensate the state for minerals the company will extract from the Yellow Dog Plains.

Charlotte Loonsfoot, a member of the Baraga-based Keweenaw Bay Indian Community that opposed the Eagle mine, said Kennecott should pay a “hefty” severance tax to compensate the state for minerals the company will extract from the Yellow Dog Plains.

“Kennecott is shipping OUR precious metals over to China to make a quick buck while we face school closings here at home. It’s not fair,” Loonsfoot said in a recent letter published in the Marquette Mining Journal.

Even without a severance tax, the state estimates Kennecott will pay $170 million in royalties and property taxes; some of those funds would benefit local units of government and the Republic Michigamme School District.

Kennecott officials did not return calls or emails seeking comment.

Mining is a $2 billion per year industry in Michigan; oil and natural gas production is a $2.1 billion industry, according to state and industry data.

Michigan in 2010 collected $57 million in severance taxes from oil and natural gas producers, certain logging operations and low-grade iron mines, according to the study by Public Sector Consultants, a Lansing-based research firm.

By contrast, the oil industry in 2010 paid the state a record $178 million for mineral leases that will allow companies to extract oil and natural gas on state land. The unusually profitable lease sale was fueled by interest in natural gas deposits found deep beneath northern Lower Michigan.

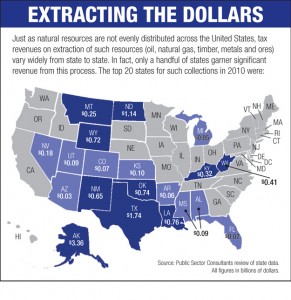

Michigan ranked 19th nationally in severance tax revenue collected from extractive industries in 2010. That was about average, considering the state’s rank among states that produce oil and gas, timber and mine metals, according to the PSC study.

“Michigan ranks in or close to the top one-third of producers of oil, gas, minerals/metals and timber,” the study found. “The state ranks 19th overall in severance tax collected, which is comparable to its rank in terms of overall production of these natural resources.”

Severance taxes differ from local property taxes and royalties that companies pay the state in exchange for permission to remove oil, natural gas and minerals from state land. Severance taxes are assessed on commodities such as oil, natural gas, timber and minerals when those resources are “severed” from the ground. The taxes are designed to offset the loss of taxable resources and provide revenue for public services, such as new roads and police and fire protection, according to the Public Sector Consultants study.

The lack of a severance tax on high-grade metallic mines could leave communities footing the bill for roads and other public services needed to support new mines that could sprout across the U.P.

“In this era of globalization and relatively high commodity prices, resource-based industries continue to expand their activities and governments face the need to implement appropriate and modern revenue structures,” the PSC report stated.

Wyant said State Rep. Matt Huuki, a Republican from the U.P. community of Atlantic Mine, is considering introducing legislation that would impose a severance tax on high-grade metallic mines. Huuki, an ardent supporter of mining, did not respond to requests for comment on the issue.

A severance tax on metallic mines could pump desperately needed revenue into state coffers. Florida, for example, levies an 8 percent tax on solid minerals extracted from the ground.

A similar tax on Kennecott’s Eagle mine -- which could produce a haul of nickel and copper worth about $5 billion -- would generate $400 million for the state’s general fund.

Kennecott’s parent company, Rio Tinto, earned $14 billion in profits in 2010. That was nearly triple the $4.9 billion profit the company reported in 2009, according to its annual report.

State officials are currently assessing the value of the ore body at Kennecott’s Eagle mine. That assessment will determine how much the company pays in local property taxes and state royalties on the metals that are extracted.

A 2007 state Department of Natural Resources analysis of Kennecott’s mine concluded that the project, over the life the mine, would pay about $100 million in royalties to the state, $20 million in state income tax and $50 million in local property taxes. Global market prices for nickel and copper were slightly higher when that study was conducted, according to DNR officials.

The Kennecott mine will employ 200 workers as the mine is being built, according to company officials. The work force will shrink to about 75 full-time workers once the mine begins operating.

Although modern mines employ relatively few people, mine workers earn an average of $85,000 annually, according to industry data.

In 2010, Michigan’s mining industry employed 6,388 workers — less than one-tenth of 1 percent of all jobs in the state, according to government data.

Michigan is national player on extraction

Michigan in recent years ranked 11th nationally in the volume of minerals that were mined, 14th in natural gas production, 17th in crude oil production and 16th in timber production, according to state data.

Mining production could jump dramatically when Kennecott begins extracting nickel and other metals from the Eagle mine in 2013. Company officials say the mine will produce about 32 million pounds of nickel and 20 million pounds of copper annually.

Those pounds can be extracted without paying severance tax, unless the Legislature changes Michigan’s tax code.

The state now levies a 5 percent severance tax on natural gas wells, a 6.6 percent tax on oil wells and a 1.1 percent tax on low-grade iron ore mining operations. There are no severance taxes on non-ferrous mining operations such as the Kennecott mine.

Logging companies enrolled in the state’s Commercial Forest Program pay a tax of $1.20 per acre where timber is harvested.

The Public Sector Consultants study concluded that Michigan’s severance tax on natural gas wells was “slightly on the low end,” while the tax on crude oil wells fell in the middle of the pack among states with a severance tax. Michigan ranked No. 1 among the eight Great Lakes states for severance taxes collected in 2010, according to the study.

Alaska, which is by far the nation’s largest oil producer, collected $3.3 billion in severance taxes in 2010.Texas, the nation’s largest producer of natural gas, collected $1.7 billion in severance taxes, according to the PSC study.

In addition to severance taxes, all extractive industries in Michigan pay local property taxes and state businesses taxes. Extractive industries also pay tens of millions of dollars annually in royalties for oil, natural gas and minerals extracted from state-owned land.

The royalty payments go into the Michigan Natural Resources Trust Fund, which acquires land to preserve sensitive natural features and provide recreational opportunities. Since its inception in 1976, the trust fund has collected about $1 billion in royalties from extractive industries, mostly oil and gas, and provided more than $800 million in grants for park improvements, fishing access sites and to acquire land for recreational purposes.

Because the MNRTF recently hit its funding cap of $500 million, royalties paid by extractive industries are now going into the State Park Improvement Fund. Those royalty payments will speed state efforts to eliminate a $340 million backlog of improvements needed at Michigan’s state parks.

A severance tax on metallic sulfide mines could pump revenue directly into the state’s general fund, where the money could be used for any purpose.

Barry Rabe, a professor of environmental and public policy at the University of Michigan, said then-Alaska Gov. Sarah Palin boosted that state’s finances by ushering through an increase in the severance tax on crude oil in 2007.

“Many other states are increasingly exploring this issue, considering ways to generate revenue either to cover regulatory costs or diversify funds,” Rabe said. “All of these are potentially on the table for Michigan going forward.”

* CLARIFICATION: A review of the PSC report led to revisions to sections involving the logging sector in February 2012. The changes, in summary, are made to reflect the following points:

1. Michigan has two tax-related programs. Both of which function as incentives rather than revenue generators, despite one of them being called a "specific tax."

2. The only source of net revenue generation is the state's sale of timber on state-owned lands, and those are deposited in the Forest Development Fund.

Business Watch

Covering the intersection of business and policy, and informing Michigan employers and workers on the long road back from coronavirus.

- About Business Watch

- Subscribe

- Share tips and questions with Bridge Business Editor Paula Gardner

Thanks to our Business Watch sponsors.

Support Bridge's nonprofit civic journalism. Donate today.

See what new members are saying about why they donated to Bridge Michigan:

- “In order for this information to be accurate and unbiased it must be underwritten by its readers, not by special interests.” - Larry S.

- “Not many other media sources report on the topics Bridge does.” - Susan B.

- “Your journalism is outstanding and rare these days.” - Mark S.

If you want to ensure the future of nonpartisan, nonprofit Michigan journalism, please become a member today. You, too, will be asked why you donated and maybe we'll feature your quote next time!